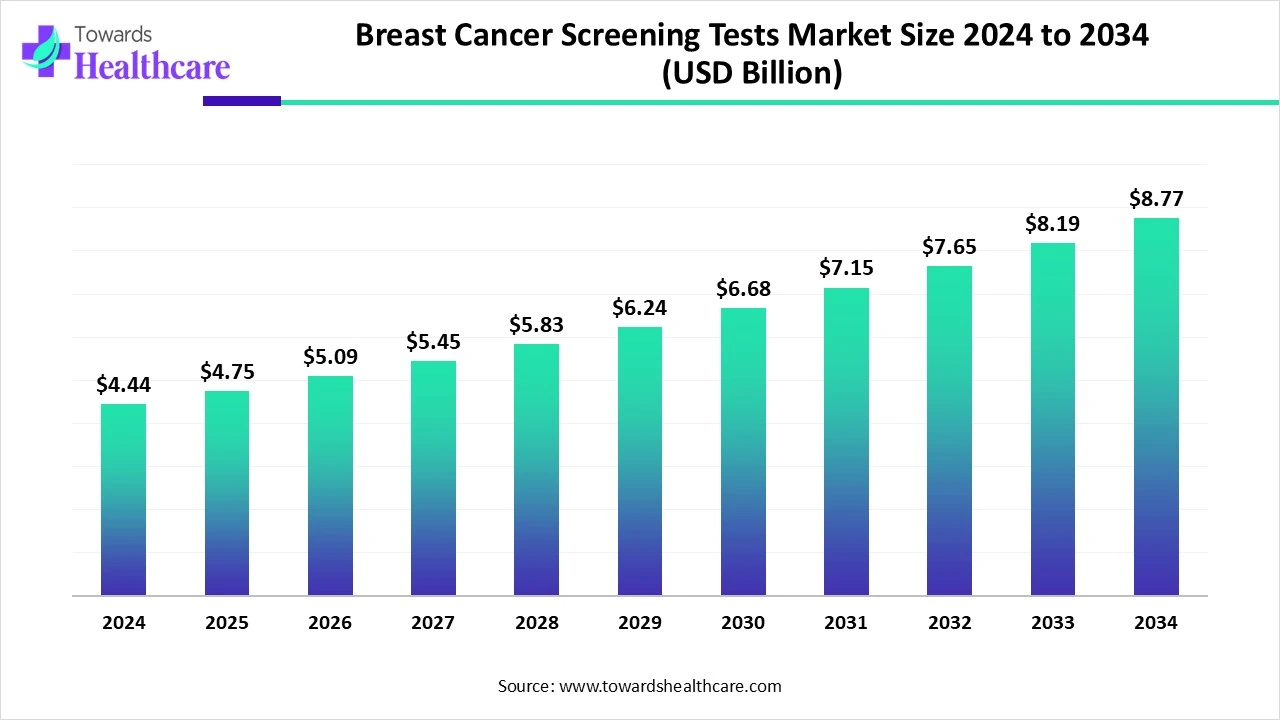

Breast Cancer Screening Tests Market to Reach USD 8.77 Billion by 2034, Shows Steady 7.04% CAGR

The global breast cancer screening tests market size is calculated at USD 4.75 billion in 2025 and is expected to reach around USD 8.77 billion by 2034, growing at a CAGR of 7.04% for the forecasted period.

Ottawa, Nov. 18, 2025 (GLOBE NEWSWIRE) -- The global breast cancer screening tests market size was valued at USD 4.44 billion in 2024 and is predicted to hit around USD 8.77 billion by 2034, rising at a 7.04% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5847

Key Takeaways

- The breast cancer screening tests market will likely exceed USD 4.44 billion by 2024.

- Valuation is projected to hit USD 8.77 billion by 2034.

- Estimated to grow at a CAGR of 7.04% from 2025 to 2034.

- North America dominated the market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the 2025-2034.

- By test type, the imaging tests segment was dominant in the market in 2024.

- By test type, the blood marker tests segment is expected to witness rapid expansion in the studied years.

- By sample type, the tissue biopsy segment led the breast cancer screening tests market in 2024.

- By sample type, the blood segment is expected to be the fastest-growing in the coming years.

- By collection site, the hospitals segment registered dominance in the market in 2024.

- By collection site, the home-based testing segment is expected to grow rapidly during the forecast period.

- By application, the early detection segment accounted for a major share of the market in 2024.

- By application, the post-treatment monitoring segment is expected to witness rapid growth during 2025-2034.

- By end user, the healthcare providers segment held the largest share of the market in 2024.

- By end user, the home users segment is expected to be the fastest-growing in the upcoming years.

What are the Breast Cancer Screening Tests?

Involvement of mammography, ultrasound, and MRI, with ongoing advances, is emphasising 3D mammography (tomosynthesis) for well-resolution image detail, and AI-assisted analysis is impacting the overall expansion of the breast cancer screening tests market. The market is propelled by the increasing cancer instances, escalated patient and public awareness, developments in screening technologies, including AI and 3D mammography, and government initiatives. Recent updates further comprise the U.S. Preventive Services Task Force's recommendation for average-risk women to begin annual mammograms at age 45.

Key Metrics and Overview

| Metric | Details | |

| Market Size in 2025 | USD 4.75 Billion | |

| Projected Market Size in 2034 | USD 8.77 Billion | |

| CAGR (2025 - 2034) | 7.04 | % |

| Leading Region | North America | |

| Market Segmentation | By Test Type, By Sample Type, By Application, By End User, By Region | |

| Top Key Players | Hologic Inc., Siemens Healthineers, GE Healthcare, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Medical Corporation, Toshiba Medical Systems Corporation, Samsung Medison Co., Ltd., Mindray Medical International Limited, Varian Medical Systems, Exact Sciences Corporation, Guardant Health, Natera Inc., Biocept Inc., Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Illumina Inc., Color Health | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Major Drivers in the Market?

A crucial driver is the widening awareness from both governments and private organisations regarding the significance of early detection for higher survival rates is widely supporting the global breast cancer screening tests market progression. Moreover, the key players are promoting major advances in molecular biology to explore innovative diagnostic techniques by applying biomarkers, like ELISA, fluoro-immunoassay, and immunohistochemistry.

What are the Key Drifts in the Market?

- In October 2025, Color Health partnered with Google Cloud to accelerate access to breast cancer screening.

- In September 2025, the Breast Cancer Research Foundation (BCRF) made a record-breaking $74.75 million investment in breast cancer research for 2025–2026, funding more than 260 scientists across 16 countries.

- In July 2025, Medtech Startup the Blue Box closed €3M seed round to revolutionise breast cancer screening.

What is the Emerging limitation in the Market?

The need for high investment in the acquisition and maintenance of sophisticated technologies, including 3D mammography, MRI, and AI-enabled tools, is creating a vital hurdle in the breast cancer screening tests market. The robustness of AI in improvements in diagnostics, their execution is facing a major risk regarding data storage, compatibility with existing systems, and the requirement for training healthcare professionals.

Regional Analysis

Why did North America Dominate the Market in 2024?

North America held the biggest share of the market in 2024. A rise in cases of breast cancer, quicker advances in screening technology, and supportive public and private initiatives for early detection are impacting the overall expansion. In the initial phase of September 2024, the FDA required that all mammography reports consist of a statement informing patients if they have dense breasts.

For instance,

- In June 2025, the U.S. Food and Drug Administration (FDA) approved De Novo authorization to Clairity Breast, the first-ever AI-enabled platform that estimates a woman’s risk of developing breast cancer over the next five years.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What Made the Asia Pacific Grow Significantly in the Market in 2024?

In the prospective period, the Asia Pacific is anticipated to expand at a rapid CAGR in the breast cancer screening tests market. The increasing ageing populations, boosting healthcare spending, and a wider focus on early detection through alliances and the adoption of mobile health technologies are fueling the regional market development. ASAP researchers are exploring a broader range of integration of artificial intelligence (AI), which will further support radiologists, and the implementation of abbreviated MRI as a more accessible and inexpensive screening tool.

For instance,

- In October 2025, Gene Solutions, a leading genetic testing innovator in Asia, partnered with AMPATH (American Institute of Pathology and Laboratory Sciences to introduce a new advanced genomics laboratory in Hyderabad.

Breast Cancer Screening Tests Market: Recent Initiatives in 2025

| Mexico Government | In October 2025, it invested MX$8 billion in the program to support the Universal Care Model for Breast Cancer. |

| IARC and Dharmais Cancer Hospital, Indonesia | In September 2025, they launched the Ultra3-CBE project to boost breast cancer screening. |

Segmental Insights

By test type analysis

Which Test Type Led the Breast Cancer Screening Tests Market in 2024?

The imaging tests segment accounted for the largest share of the market in 2024. The segment is primarily driven by growing technological advancements, such as 3D tomosynthesis and AI-enhanced diagnostics. Nowadays, the globe is promoting the use of contrast-enhanced spectral mammography (CESM), which is the latest solution that applies an iodine-based contrast dye to address areas of enhanced blood flow linked with tumours. The market is putting efforts into innovations in AI-enabled thermography, elastography, and MRI with specialised coils.

However, the blood marker tests segment will expand rapidly during 2025-2034. The world is focusing on the widespread use of less invasive diagnostic approaches and blood tests, especially liquid biopsies, which are a more convenient and non-invasive solution. The latest adoption of tailored blood tests, such as Signatera, which assist in identifying a patient's unique tumour mutations from an initial blood and tissue sample. These novel methods are accelerating the detection of ctDNA fragments in the blood, which acts as a less invasive way of tracking cancer growth and drug resistance.

By sample type analysis

How did the Tissue Biopsy Segment Dominate the Market in 2024?

The tissue biopsy segment held a major share of the breast cancer screening tests market in 2024. The widespread benefits of core-needle and vacuum-assisted biopsies are supporting the reduction of patient discomfort, lowering recovery times, and less complications. Currently, the market is leveraging phenomenal advances in liquid biopsy for real-time monitoring and developments in vacuum-assisted biopsy (VAB) for better samples and minimised invasiveness.

Although the blood segment is predicted to register the fastest expansion. Primarily, innovations in blood tests, like liquid biopsies, are assisting the analysis of circulating tumour cells and cell-free DNA. The wider emergence of AI tools, especially RED (Rare Event Detection), is established to enhance the analysis of blood samples, which is robust than current methods that need human oversight. This era is imposing ultra-sensitive liquid biopsies for the prediction of recurrence, testing for treatment resistance, and identifying genetic mutations for targeted therapy.

By collection site analysis

Which Collection Site Led the Breast Cancer Screening Tests Market in 2024?

In 2024, the hospitals segment held a dominant share of the market. Hospitals are increasingly using 3D mammography, AI-enabled mammography, molecular breast imaging (MBI), and CEM for more effective cancer detection. They possess various oncologists, radiologists, pathologists, and surgeons to facilitate complete, tailored care, with the use of advanced technologies, like MRI and ultrasound, for screening, diagnosis, and ongoing monitoring.

Moreover, the home-based testing segment is estimated to witness the fastest growth. The rising demand for convenient and accessible solutions for tracking their health, mainly for those who find traditional screening methods challenging or time-consuming. This further transforms wearable devices into an ultrasound patch for continuous monitoring, AI-driven thermal imaging, and blood tests for detecting cancer biomarkers.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By application analysis

What Made the Early Detection Segment Dominant in the Market in 2024?

The early detection segment led with a major revenue share of the breast cancer screening tests market in 2024. The segment is widely driven by escalated survival rates and treatment options, which are further connected with diagnosing the disease in its initial stages. Furthermore, researchers are working on the exploration of the application of markers for breast stiffness in the identification of cancer in dense breasts, and breath analysis, employing electronic nose (E-Nose) technology for cancer detection.

The post-treatment monitoring segment will expand rapidly in the coming era. The globe is focusing on risk-based surveillance, with the rising role of circulating tumour DNA (ctDNA) blood tests for the determination of reduced residual disease. As well as the market is bolstering consistent revolution in advanced imaging techniques, including digital breast tomosynthesis (DBT) and diffusion-weighted imaging (DWI), which supports the post-treatment monitoring.

By end user analysis

Why did the Healthcare Providers Segment Dominate the Market in 2024?

The healthcare providers segment captured the biggest share of the breast cancer screening tests market in 2024. The combination of factors, such as a rise in demand for early detection, continuous innovation and the development of advanced technologies, specifically 3D mammography and AI-driven solutions, and technological advances in screening and diagnostic tools, is fostering the segmental expansion.

On the other hand, the home users segment is anticipated to expand fastest during 2025-2034. Specific immersion of telehealth and remote patient monitoring services has made it convenient for users to consult with healthcare professionals remotely after employing an at-home test. The latest research activity comprises the design of a wearable ultrasound patch, which is introduced into a bra for continuous or often breast monitoring by the Massachusetts Institute of Technology (MIT).

Revolutionary Developments in the Breast Cancer Screening Tests Market

- In September 2025, Punjab unveiled first-of-its-kind AI-assisted screening devices for early detection of breast cancer, cervical cancer and refractive errors.

- In September 2025, Axia Women’s Health introduced an FDA-granted artificial intelligence (AI) technology with every mammogram at an affordable expense to patients.

- In January 2025, SimonMed Imaging, a provider of outpatient medical imaging services in the United States, launched its AI-powered Personalized Breast Cancer Detection (PBCD) program.

Browse More Insights of Towards Healthcare:

The global carrier screening market size is calculated at US$ 3.09 billion in 2025, grew to US$ 3.70 billion in 2026, and is projected to reach around US$ 18.58 billion by 2035. The market is expanding at a CAGR of 19.65% between 2026 and 2035.

The global drug screening market size was estimated at US$ 6.15 billion in 2023 and is projected to grow to US$ 10.34 billion by 2034, rising at a compound annual growth rate (CAGR) of 4.84% from 2024 to 2034.

The global newborn screening market size is calculated at USD 3.44 billion in 2024 and is expected to be worth USD 6.46 billion by 2034, expanding at a CAGR of 6.5% from 2024 to 2034.

The global next generation sequencing market size is calculated at US$ 10.27 billion in 2024, grew to US$ 12.51 billion in 2025, and is projected to reach around US$ 73.47 billion by 2034. The market is expanding at a CAGR of 21.74% between 2024 and 2034.

The global cellular health screening market size is calculated at USD 3.37 billion in 2024, grew to USD 3.68 billion in 2025, and is projected to reach around USD 8.14 billion by 2034. The market is expanding at a CAGR of 9.24% between 2025 and 2034.

The bone densitometer market is anticipated to grow from USD 335.42 million in 2025 to USD 489.94 million by 2034, with a compound annual growth rate (CAGR) of 4.3% during the forecast period from 2025 to 2034.

The global high content screening market size is calculated at USD 1.52 billion in 2024, grew to USD 1.63 billion in 2025, and is projected to reach around USD 3.12 billion by 2034. The market is expanding at a CAGR of 7.54% between 2025 and 2034.

The U.S. drug screening market size is calculated at US$ 2.70 in 2024, grew to US$ 2.79 billion in 2025, and is projected to reach around US$ 3.84 billion by 2034. The market is expanding at a CAGR of 3.64% between 2025 and 2034.

Breast Cancer Screening Tests Market Key Players List

- Hologic Inc.

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Hitachi Medical Corporation

- Toshiba Medical Systems Corporation

- Samsung Medison Co., Ltd.

- Mindray Medical International Limited

- Varian Medical Systems

- Exact Sciences Corporation

- Guardant Health

- Natera Inc.

- Biocept Inc.

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific

- Illumina Inc.

- Color Health

Segments Covered in the Report

By Test Type

- Imaging Tests

- Mammography

- Ultrasound

- MRI

- Digital Breast Tomosynthesis (3D Mammography)

- Genomic Tests

- BRCA1/BRCA2 Testing

- Multi-Gene Panel Testing

- Blood Marker Tests

- Circulating Tumor DNA (ctDNA) Tests

- Liquid Biopsy Tests

- Immunohistochemistry Tests

- Hormone Receptor Testing

- HER2 Testing

- Others

- Molecular Assays

- MicroRNA Profiling

By Sample Type

- Blood

- Tissue Biopsy

- Urine

- Saliva

- Others

By Collection Site

- Hospitals

- Diagnostic Laboratories

- Clinics

- Home-Based Testing

- Others

By Application

- Early Detection

- Risk Assessment

- Post-Treatment Monitoring

- Research & Development

- Others

By End User

- Healthcare Providers

- Hospitals

- Clinics

- Diagnostic Laboratories

- Research Institutions

- Home Users

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5847

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.